TradFi, FinTech, and DeFi Convergence

Stablecoins here, stablecoins there, stablecoins everywhere. The ongoing convergence of traditional finance (TradFi) and decentralised finance (DeFi) continues to capture the limelight, and stablecoins are the main driver. At Florin Digital, we've engaged with numerous experts across both DeFi and TradFi to explore this topic deeply. Our discussions spanned over 3+ months and 50+ conversations. Today, we're excited to share more on our stablecoin thesis, key data points, and valuable insights distilled from these conversations.

Our stablecoin thesis

Stablecoins offer global access and programmability, mixing the familiarity of fiat with the speed and flexibility of blockchains to enable fast payments and new digital finance tools. We believe that stablecoins are a case study for incumbent financial institutions on what can be built on a global, instant settlement layer. It also enables technology companies, previously blocked from offering financial services to enter a new market. Stablecoins are the disruptive force that push financial institutions to bring true innovation to their product offering.

While thousands of stablecoins may appear, only a select few will achieve genuine currency-like adoption. Currently, USDC and USDT are in the lead, but we view them as the Netscape and Yahoo of stablecoins, not the eventual Google or Facebook. We foresee numerous specialized stablecoin issuers emerging as barriers to entry come down, regulatory frameworks solidify, tax issues clarify, and stability/security concerns are resolved. This shift is already well underway but will take years to fully mature.

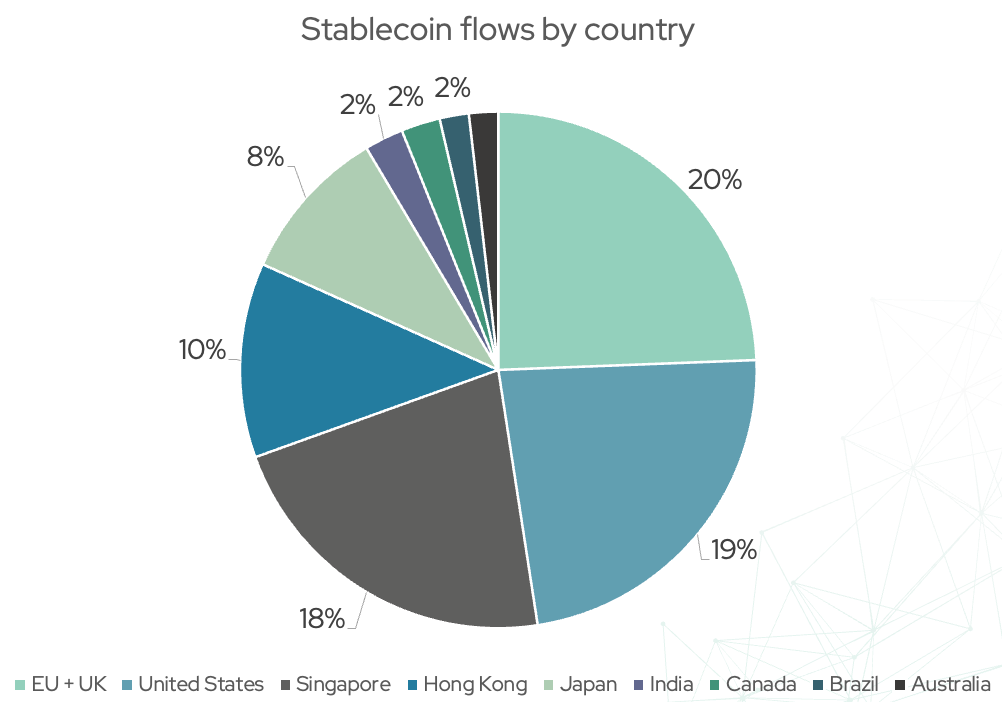

Sector and geography-specific stablecoins will emerge, supported by hubs facilitating trillions in volume. To the end user, a Goldman Sachs-issued stablecoin (gsUSD) moving to JPMorgan would undergo a seamless conversion, invisible to those interfacing, but enormously profitable for the entity facilitating this conversion on the back-end.

Key Learnings

TradFi’s cautious nature limits their appetite for innovation and leaves the door open for a new type of competitor: TradFi’s inherent reluctance to explore new products and ideas, banks replicate traditional processes on-chain, such as T+2 settlement and inefficient AML/KYC processes. Even though there are more efficient and compliant solutions available, TradFi has typically shied away from incorporating them. This conservative, compliance-driven approach creates opportunities for FinTechs and tech companies to innovate and offer entirely new financial services, capturing market share from the slower-moving incumbents. Circle, for example, ranks 50th on the list of US Banks by asset size, Tether #33 - this is just one of many examples where slow moving incumbents with low incentives to innovate have fallen behind.

DeFi has compromised on its original libertarian vision to expand into TradFi distribution: Rooted originally in libertarian ideals, DeFi has shifted largely to permissioned and centralized products to reach a broader audience. Today’s leading stablecoins (USDT, USDC), which represent more than 85% of all stablecoins in circulation. Their centralized nature allows them to integrate with traditional financial rails and unlock global distribution at scale.

Distribution is the key to stablecoin dominance: The success of any stablecoin depends less on technical design and more on distribution. Centralized exchanges (CEX), FinTechs, and banks that own the customer relationship will dominate the market for money-like stablecoins akin to USDC and USDT. In DeFi however, the Pendle protocol (a marketplace allowing consumers to access a variety of stablecoins) is winning the distribution game. Over one third of stablecoins are distributed via the Pendle marketplace to customers.

Software companies and FinTechs are best positioned to benefit from the convergence of DeFi and TradFi: Tech firms are rapidly embedding payments and financial services into their platforms, many doing so natively. Stablecoin-based payments will make this even easier. Over time, more of them will take a cut of the economic activity they enable, transforming from pure software providers into financial intermediaries.

Decentralized infrastructure brings major benefits to TradFi products: While many DeFi products today (like tokenization or zero-coupon bonds) mirror TradFi attributes, they’re fundamentally improved by being built on this new infrastructure. The winning formula is clear: use decentralized rails to make traditional financial products faster, more efficient, and globally accessible.

Market makers will serve as the connective tissue between TradFi and DeFi: Just as large institutions don’t directly trade equities but route through brokers and liquidity providers, they also will not directly engage with DeFi. Market makers will play a critical backend role, executing trades via stablecoin liquidity platforms like Curve or Maker and as institutional adoption of tokenized assets grows, the role of market makers in this space is set to rise even further.

CEXes will benefit early from the stablecoin explosion, but DeFi will win in the long run: In the short term, centralized exchanges are best positioned to capture the influx of new stablecoins, offering easier access due to existing distribution rails and more attractive yields than DeFi platforms. However, over a 5 to 10 year horizon, DeFi will outcompete CEXes on efficiency and composability all of which translate to improved capital optimization.

Stablecoins are TradFi’s gateway drug: Crypto rails offer clear technological advantages for traditional finance. Stablecoins are the first real use case that demonstrates this, delivering lower costs, instant settlement, and better consumer experiences. Now that TradFi has seen the benefits, we believe it will increasingly adopt more decentralized and interconnected systems to stay competitive.

Clear regulation will shape the winners in DeFi and TradFi convergence: Jurisdictions with well-defined crypto rules, like the EU under MiCA, are pulling ahead in attracting institutional interest and capital. In Europe, Société Générale, Deutsche Bank and ING are first movers, but broader adoption is still slowed by institutional caution and reputational concerns.

KYC will not always be as cumbersome as it is today: While traditional KYC remains the norm, the long-term trajectory points toward on-chain compliance powered by advanced analytics and wallet-level monitoring. These systems promise a more flexible and effective approach to identity verification, likely replacing static KYC over the next five years.

About Florin Digital

www.florindigital.io

General Disclaimer

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any fund, including the digital asset strategies described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. There is the possibility of loss, and all investment involves risk including the loss of principal. Florin Digital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Florin Digital and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions.

It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity, security, or asset. Florin Digital has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.