The Interchain Future: Synapse Protocol

A real, profitable, free-driven business model with a technology moat

[Published October 2023, the SYN token traded at approx. $0.30 as of original publishing]

Executive Summary

Today, blockchains are isolated cables connected to each other through siloed, inefficient processes – for blockchains to be successful in the long-term, interoperability solutions are required

Many acknowledge interoperability as a requirement; however, none but Synapse have built what the next solution will look like

Synapse Protocol currently provides the foundations of this interchain future through its messaging and bridging products

The launch of SynChain and Synapse Interchain Network (“SIN”) cement Synapse as the future of interoperability

Synapse as a product has already achieved product-market fit, it continues to expand and fortify its position as a piece of integral interoperability infrastructure. If interoperability is the end game, Synapse is a core piece of it

The fee model of the protocol is simple to understand and hyper-scalable, it is a traditional business model that can scale with the digital asset industry’s growth

Protocol Background

Overview

Originally launched as Nerve Finance, Synapse was a first mover in the cross-chain messaging and bridge space. Their key products include: (i) Bridging (ii) Stableswaps (iii) NFT messaging and (iv) in testing a Layer-2 interoperability blockchain

Core development team (Synapse Labs) of approximately ten, most public facing are Aurelius, 0xSocrates, Trajan, Chi Squared, and Moses (Github, Docs)

Part time contributors Bottomseller, Parsa, Tomy

Foundation Advisory Board: Currently in formation, authorized. Synapse utilizes a Cayman Foundation for its protocol-related operations

Marketing Sub-Dao: In early stages of organization, SIP expected shortly

The team and contributors are active on Telegram, Discord, and Mirror

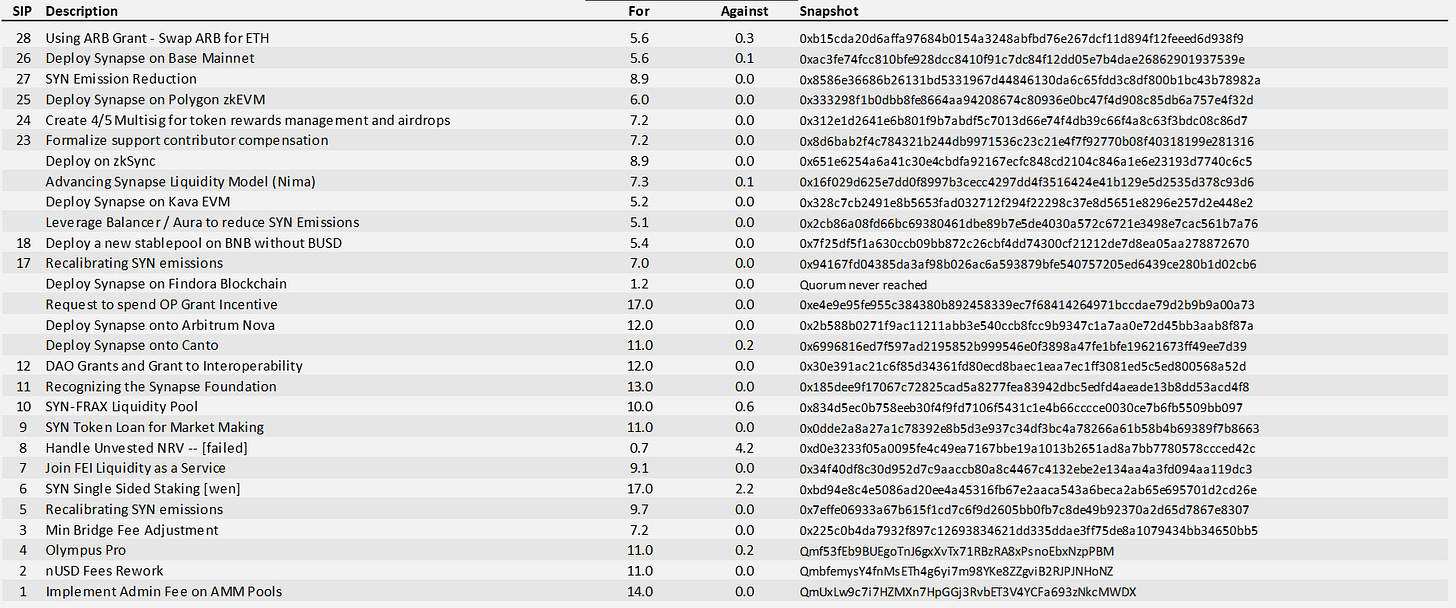

Community Involvement: 20+ SIPs authored, new chains added, various other proposals

Products

Today, the Synapse ecosystem consists of two major products. Its bridging and stableswap solutions have considerable product market fit. Cross-chain messaging has not yet seen broad adoption outside of DeFi Kingdom

Bridging

Utilize Synapse to transfer assets from one chain to another, for a small fee. Synapse adds utility to this process primarily through faster bridging times and utilizing only native assets to reduce risk

Synapse supports 19 chains and has bridged over $14B in value

Stableswaps

Through Synapse, various stablecoins (USDC, USDT, DAI, NOTE, etc.) users can swap stable value from chain-to-chain

Synapse supports 19 chains and has swapped over $28B in value

Cross-Chain Messages

Messages focus primarily around DeFi Kingdoms and Hero/NFT movement between Harmony, DFK Chain, and Klaytn

Transferring in-game characters via Synapse allows DFK users to utilize different version of the game on different chains simply by switching RPC

Over 2.6M transactions have been sent using this functionality

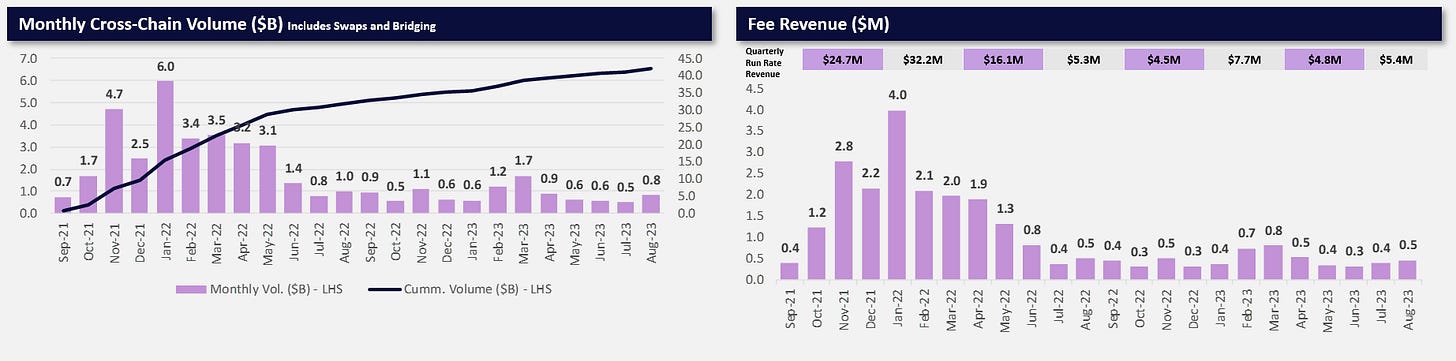

The protocol has experience real traction and real fee revenue

Its flagship bridging product has seen ebbs and flows like all in the crypto markets but it remains consistently utilized and the protocol remains consistently profitable

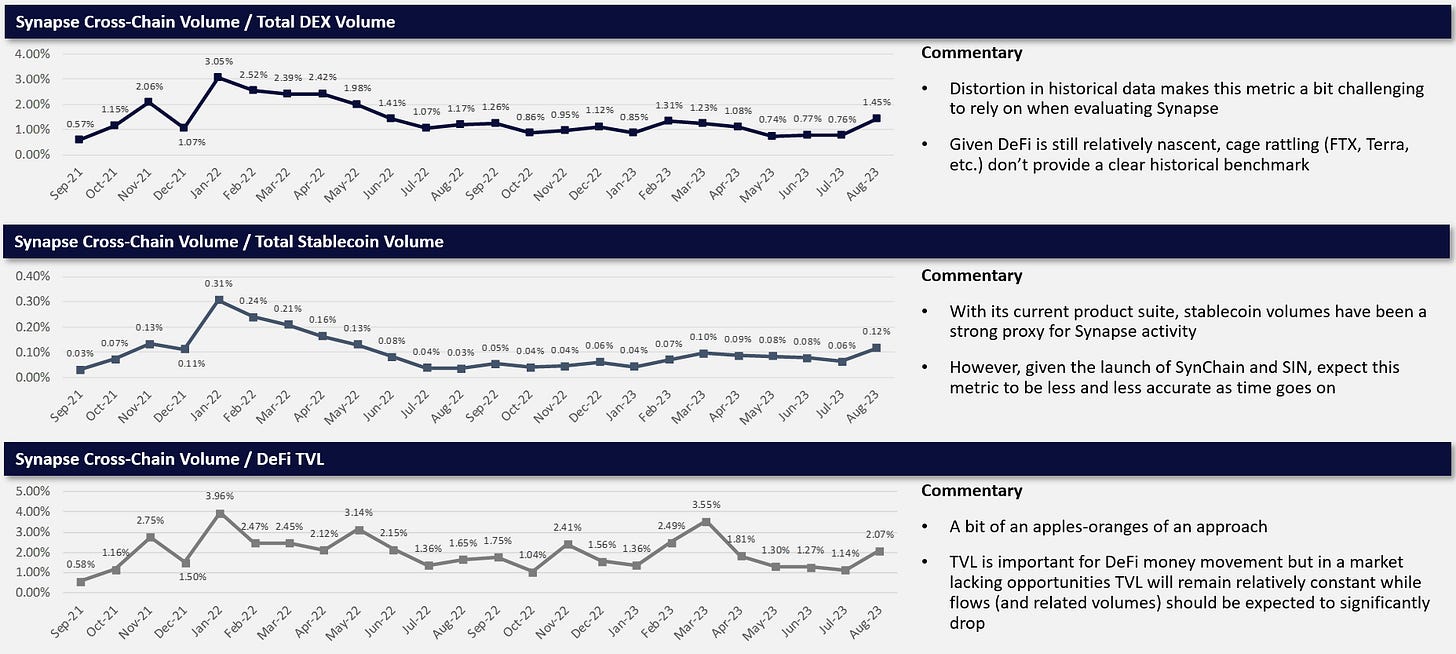

Metrics

Synapse market share is also consistently growing as is the market share of the Ethereum Virtual Machine (EVM).

EVM Blockchains control approximately $36.2B TVL or about 94% of the $38.4B total

Monolithic blockchains will no doubt continue to gain attention, but EVM dominance today is clear

Solana and Mixin lead non-EVM chains with approximately $700M in combined TVL

Chains Synapse connects represent 76% of TVL, 88% excluding TRON. Expect this continue even as more chains are added to various L2 and L3 stacks

Synapse has historically reacted quickly and effectively to changing markets

Deployment on Canto, Base, and DFK Chain provided Synapse strong first-mover positioning taking advantage of the mercenary capital of yield farmers and opportunistic on-chain investors

Network and Partnerships should continue to enable this for Synapse-core products as well as SynChain and SIN

Expected launches of new EVM and EVM integrated chains (Berachain, ZK Chains, etc.) should also help volume metrics and market share

As an on-chain first business, tracking historical metrics for Synapse can be done down to the hour.

The Future: Synapse Interchain Network

In a world with hundreds of chains, SIN is the way they will communicate each other. Anything cross-chain will be synonymous with SIN

SIN is Trustless: There no centralized oracles to be exploited, no permissioned relayers

SIN is Customizable: Developers can set the challenge period independent of the L1, they can also deploy their own custom chains and logic using SIN

Fewer and fewer applications will be deployed on directly mainnet in the future. With SIN, developers do not forgo mainnet’s security (as state roots are still posted there) and retain the ability to customize where they see fit

Synapse Chain (the Ethereum L2 chain) not only facilitates all of this, but also serves as a hub where "chain" can be abstracted. Deploy to Synapse Chain, use SIN on the backend, and you never have to leave Synapse Chain but can now interact with all other chains

Staking, validating transactions, fraud proofs, and dApps will be built on SynChain, deployed natively, and utilized across chains

Why is SynChain important?

Latency: Transfer multiple assets to multiple places, quickly. CCTP only allows for the transfer of USDC and still requires 20+ minutes to do so

Flexibility: DeFi exists for more than just payments, you need to be able to seamlessly move any asset – tokens, NFTs, positions, etc.

Speed to Market: Deploy on SynChain and out of the box you are connected to dozens of chains. There is no reason for multiple deployments like many other cross-chain solutions offer today

The Long-Term Solution: Chain Abstraction is the future – Synapse creates a platform where it never matters where something is deployed, users of SynChain will always have access

Catalysts Hiding in Plain Sight

The Market for New Blockchains

Debates will continue between developers, where they want to build, and various tradeoffs. New and more complex implementations will occur

Funding opportunities for new dApps, L2s, L3s, and monolithic blockchains continues

Regardless, Mainnet will not be the place many of these dApps deploy (ex: Friend Tech) simply due to costs

Layer 2s and Layer 3s

L2beat.com lists 32 Layer-2 networks, more continue to be added (Manta Pacific launched September 12)

There are 34 chains with over $10M in TVL according to Defillama

Additional launches have been forgotten in the bear market: berachain, Scroll, Dydx Chain

The opportunity here is two-fold

These chains will initially host a number of mercenary farmers and airdrop hunters in their early days

After launch, these chains are ultimately new “customers” for Synapse

EIP-4844:

Blob transactions should push more transaction activity to L2s as costs decrease

Increased L2 activity and speculation is positive for Synapse (see history)

EIP 4337 and Intents

With account abstraction and advances in intents, users should continue to be indifferent about how an asset gets somewhere as long as that path remains trustless and decentralized (native bridges cannot claim this, multi-sig bridges cannot claim this)

Telegram Bots

Unibot, Maestro, Bannana Gun and the like have had a helpful impact for casual users on DEXes. Enter SynChain + TG Bots, increased efficacy through cross-chain availability and efficiency

Incentives

OP Stack and Arbitrum Layer-3 chains and dApps are becoming easier to deploy, pair this with large incentives or airdrops from well capitalized DAOs/Foundations

Bear Market Fractured Liquidity

Idle liquidity continues to sit on orphan chains not fully utilized, a simplified playing field via SIN allows users to deploy liquidity where it is most efficient and profitable

Potential Upside and the Art of the Possible

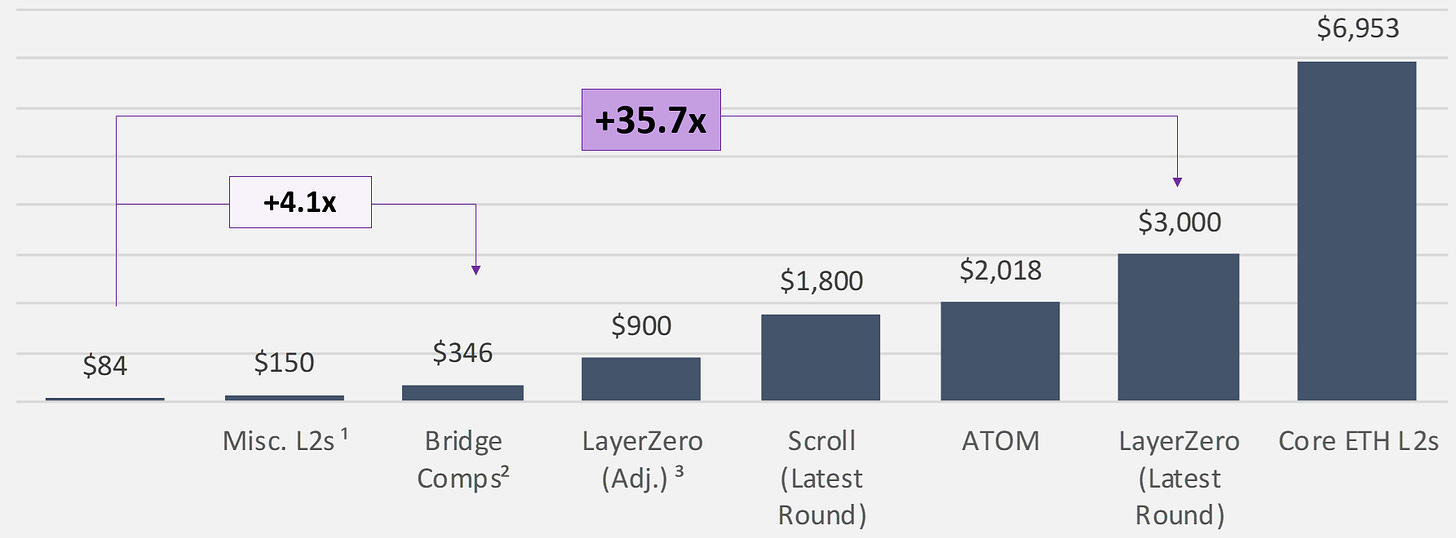

The core protocol Bridge and Stableswap assets trade are 15.5x current run rate revenue in a deep bear market

This attributes $0 in value to (1) SIN/Synchain, (2) any potential growth in the market overall, and (3) any incremental pickup in volumes

Simply valuing Synapse as an on-par solution to current bridges would be a valuation bump from these levels

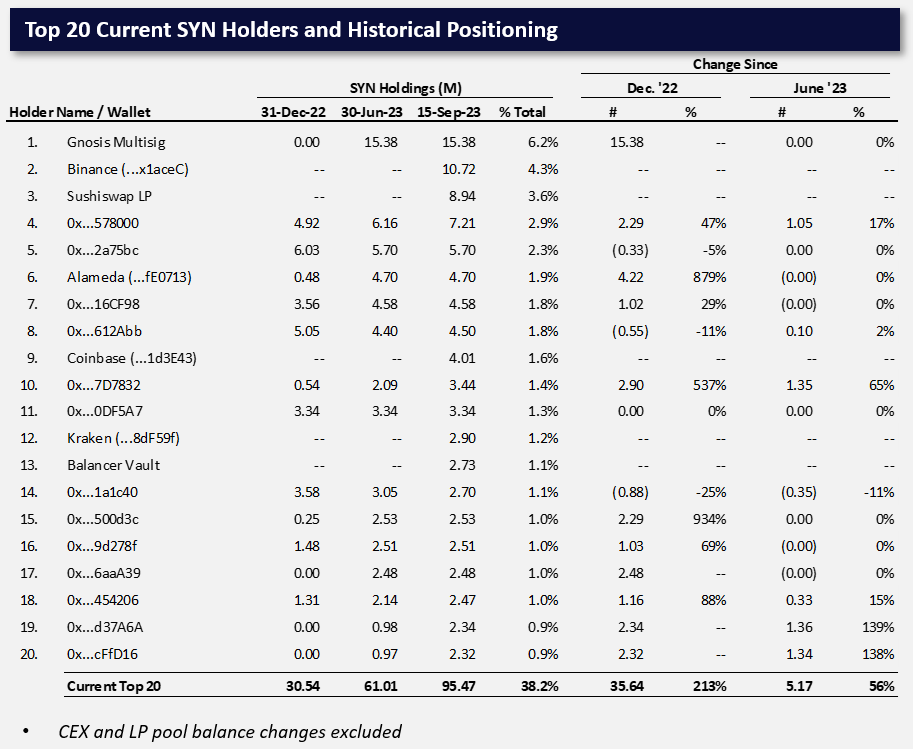

Top Holders of Synapse and Commentary

Of the current top 20 holders, only 1 decreased its positions since June 2023 and 3 decreased since December 2022

Conversely, 6 holders materially (greater than 25%) increased their positions

The FTX/ Alameda transfer is to the FTX Bankruptcy estate which should be expected to be sold though it remains a small piece (<1%) of the $2.3B estate

Appendix

Financial Overview

Governance Overview (SIPs, Synapse Improvement Proposals)

Relative Market Metrics

Full report here: https://docsend.com/view/8abc2m6m6i6kc34j

About Florin Digital

Florin Digital is a crypto-asset investment firm deploying at the intersection of finance and technology.

We seek out early-stage opportunities in liquid markets which present an asymmetric risk-reward profile. Our thesis-driven, hands-on approach allows us to unlock significant latent value in the teams and protocols that we partner with.