Institutional Yield That Scales: Welcome to Dinero

Dinero has quietly built up a powerful suite of DeFi products and partnered with some of the largest financial institutions on Earth to bring scalable yield to the masses.

Long form post below. Presentation format here

Executive Summary

Dinero Protocol (“Dinero”), formerly known as Redacted Cartel (“Redacted”) is an Ethereum-centric Decentralized Finance (“DeFi”) protocol providing a suite of institutional yield products that scale.

Dinero (pxETH and pxUSD)

pxETH is the highest yielding LST in crypto. It is also available via a white label, multi-chain solution

A key part of Dinero is Monarch, an institutional liquid staking fund partnered with Galaxy, Laser Digital (Nomura) and other soon-to-be-announced institutional partners

At over $170B in deposits generating over $5B per year, ETH Staking represents the largest pool of assets in crypto as well as one of the largest businesses. Staked ETH would be the 30th largest bank in the US by assets, the 4th by market capitalization

pxUSD is a US dollar pegged stablecoin with embedded yield and backed by pxETH which adds utility to the Dinero ecosystem

Hidden Hand

An incentives protocol for stablecoins and stable-paired assets across crypto

Hidden Hand counts Paypal as a user as well as many other crypto and defi-native protocols

Pirex

A liquid wrapper for DeFi assets providing enhanced yield and the ability to tokenize and split out each piece of an asset

Redacted is the first DeFi protocol to partner with global institutions and offer a regulated product via institutional distribution channels. This product, ipxETH, is enabled by the team’s technical ability to execute in an environment that addresses regulated and institutional requirements while also those of DeFi

Thesis Overview

With the Bitcoin and Ethereum ETFs launching in the US, institutional crypto is now a reality; savvy investors will seek to further maximize their yield on these assets (and appreciation potential) via any means available

Dinero is able to offer an institutional grade ETH product to traditional investors and also crypto-natives, pairing these two provides a number of advantages for the protocol

An opportunity to meaningfully increase TVL via TradFi channels

Increased yield for crypto-natives (due to the two-token model utilized by pxETH)

A demonstration of operational superiority and brand recognition for Dinero as the first DeFi protocol to accomplish such a feat

Growth Vectors

What is Dinero Protocol?

Overview

Dinero is a set of decentralized finance products native to Ethereum and various EVM chains that focus on scalable, institutional-grade yield. Redacted was borne out of Olympus DAO in late 2021 as a subDAO to focus specifically on the Curve Wars. The protocol launched in December 2021, via a treasury bootstrapping event, dubbed “Swallowtail”, which raised over $70M for the treasury. The native token of Dinero was BTRFLY (now DINERO). As the protocol grew, it spun out of the Olympus DAO ecosystem (eventually repurchasing its seeded tokens from Olympus DAO) and today has three main products:

Dinero: an ETH staking solution for DeFi and institutionals that is powered by a Dinero LST

Hidden Hand: Acquired in January 2022, Hidden Hand focused on incentivizing liquidity in DeFi markets

Pirex: A DeFi liquidity wrapper

In June 2024, through a governance vote, the protocol changed its name to Dinero Protocol and agreed to convert its existing governance token BTRFLY to DINERO at a ratio of 1:2000. Like BTRFLY, DINERO can be used as a functional multi-utility token for governance and economic incentives

Dinero is operated by Redacted Labs which has over 20 employees in countries across the globe.

Team

Dinero was built by Redacted Labs, an offshore company with a typical Labs-Foundation structure.

The team is globally distributed. Notably, while the perception may be that defi-native teams are disorganized and disparate, Dinero operates extremely efficiently and in a manner consistent with top tier global companies.

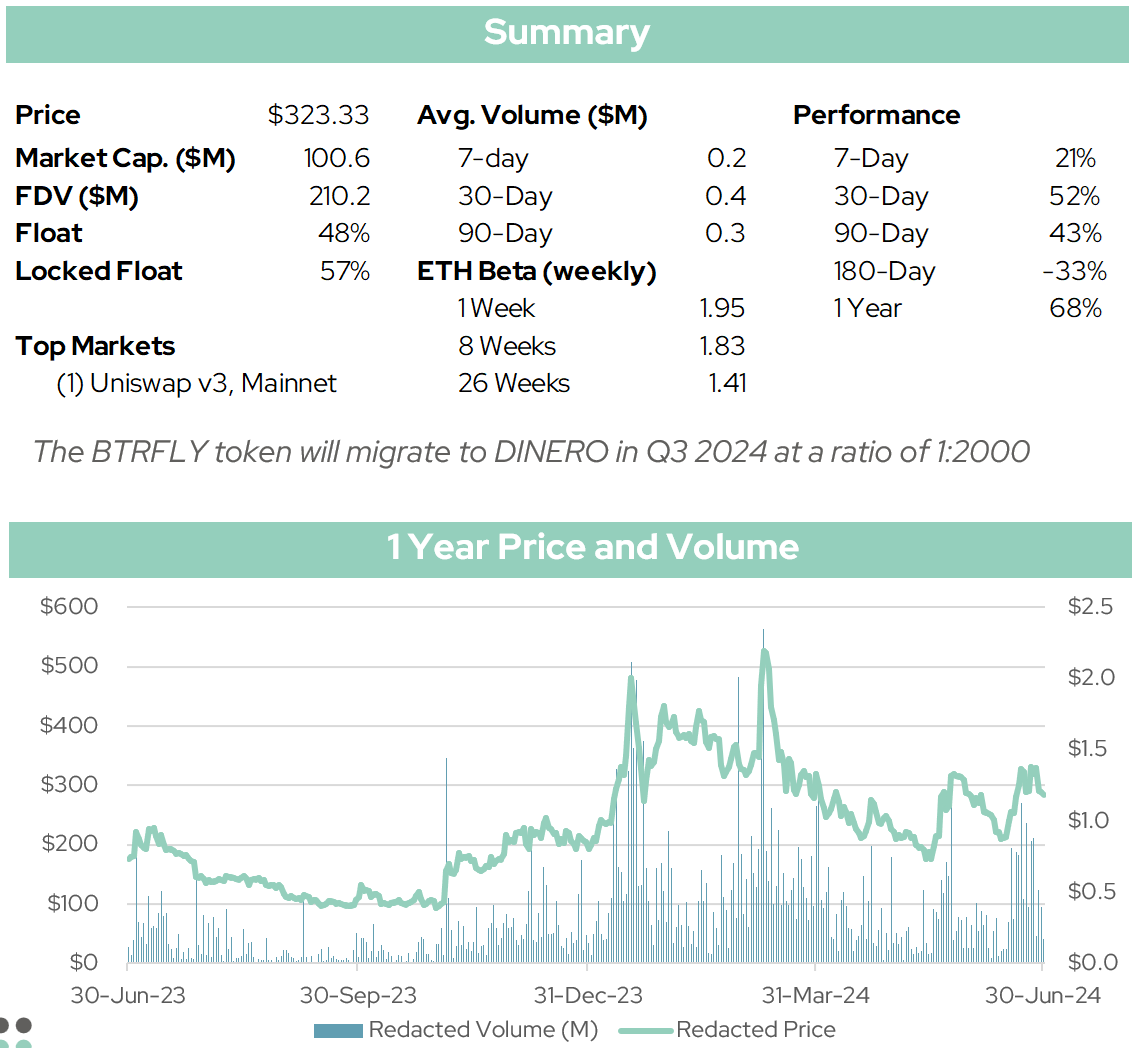

The Token (Previously BTRFLY, now DINERO) - as of July 15, 2024

BTRFLY began migrating to DINERO on July 18th. To provide historical and comparable context however, we have examined BTRFLY. Note that the two tokens are interchangeable at a ratio of 1:2000.

Historical Holders and Movements

Dinero Product Suite

ETH LSTs

Includes pxETH, apxETH, ipxETH, and branded, white-label LSTs (protocols confidential)

Current LST market is $50B in TVL, Ethereum contributes 90% to the entire market

Dinero LSTs focus on a two-token model pioneered by Frax (see appendix for full detail)

Dinero LSTs have more than double the yield of their closest competitors and ample room to scale

Dinero takes a 10% fee on yield generated, this fee is distributed 42.5% to Treasury and 57.5% distributed to Stakers

Monarch, the institutional ETH staking fund supported bi Dinero should provide additional TVL and fee revenue for stakers.

Audits (3): Spearbit pxETH, Pashov pxETH, Spearbit pxETH Infrastructure (link)

pxUSD

pxUSD is a collateralized debt position (“CDP”) stablecoin backed by Dinero’s ETH LST products. It is expected to launch in Q3

Current CDP market is approx. $10B in total size, MakerDAO controls 60% of the market with DAI

Unlike MakerDAO, Dinero is looking to utilize its CDP to increase efficiency, profitability, and utility within its own ecosystem, not DeFi broadly

This contrasts to many stablecoin and CDP providers looking to compete with the largest centralized and fiat backed stablecoins across DeFi

pxUSD is only meant to strengthen the Dinero ecosystem and add utility and flexibility to its products

Growth Vectors

As the Dinero product suite increases in TVL, pxUSD increases in utility

Total stablecoin market is approximately $161B, this is led by fiat/USD backed stablecoins (Tether $112B and USDC $32B) which combined represent 89% of the entire market

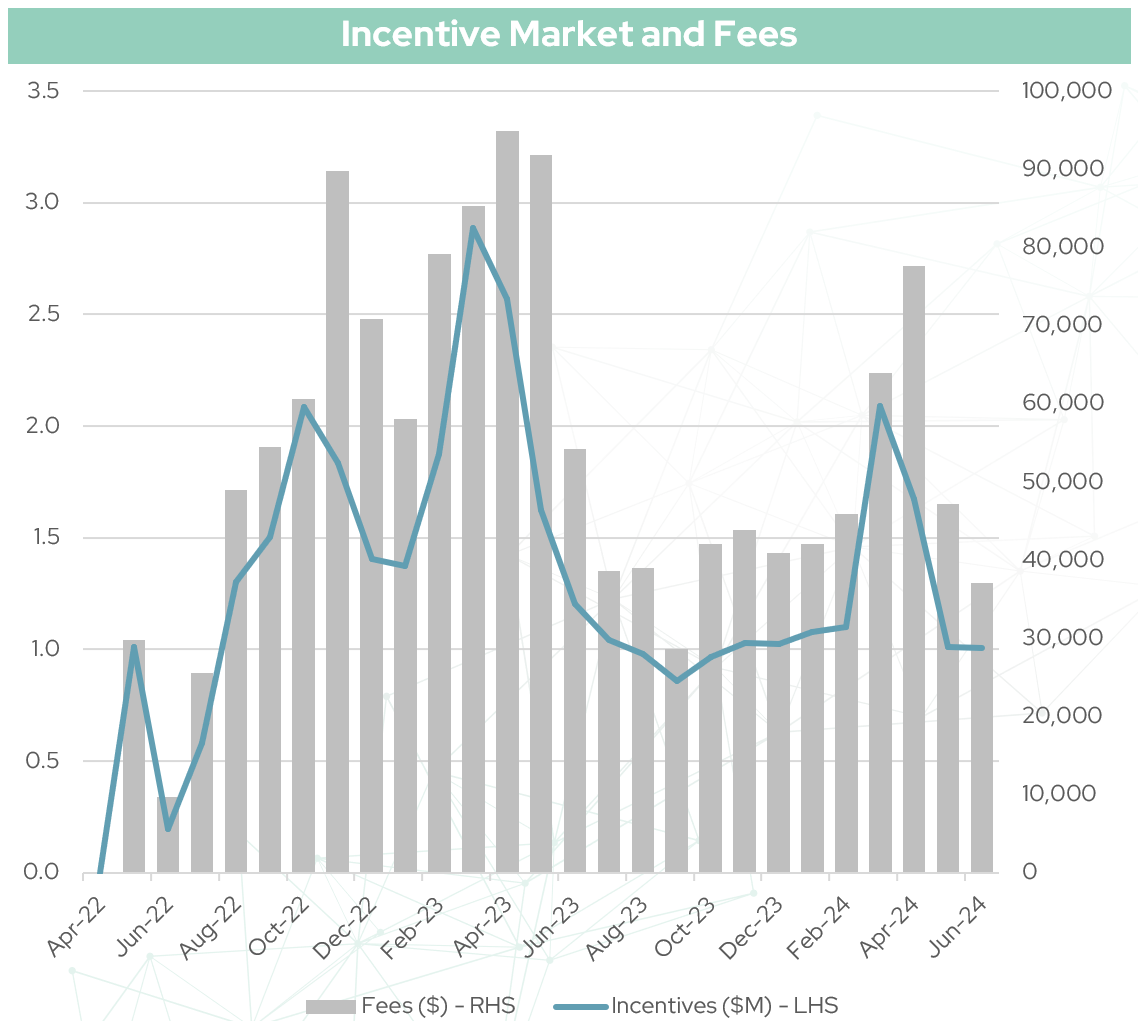

Through Hidden Hand (“HH”) Dinero generates fee revenue to incentivize DeFi liquidity. HH is available on eight chains today (Ethereum, Optimism, Arbitrum, BNB, Fantom, Linea, Zksync, Fraxtal). HH has generated approximately $1.4M in revenue since April 2022 and consistently produces $50k per month in fees. Overall, this business segment remains relatively steady. Selected HH users: Paypal, Pancakeswap, Frax, Pendle, Balancer.

Hidden Hand takes 4% of incentives provided, this fee is distributed 42.5% to Treasury and 57.5% distributed to Stakers.

Audits (3): V1, V2, Marionette

Through Pirex, Dinero generates both yield-based and fee revenue. The protocol is available on Ethereum and Arbitrum. Pirex provides liquid wrappers for locked tokens. It also also splits and tokenizes various pieces of yield bearing asset allowing for further composability. Pirex is one of the largest holder of Convex tokens in DeFi, approximately 4.8M CVX tokens providing it substantial ability to direct fees and liquidity.

Dinero takes a 10% fee on yield generated plus a 1% to 5% withdrawal fee on various products, this fee is distributed 42.5% to Treasury and 57.5% distributed to Stakers.

Audits (3): BTRFLY, CONVEX, GMX

Dinero Ecosystem and Fee Flow

Roadmap Forward and Growth Vectors

Dinero (Short Term)

Rebrand: Commenced July 18, consolidate Dinero products under one brand to provide clarity and create brand equity

Relaunch of token: 1:2000 split provides (i) a new chart for the token and (ii) a lower price per token for those focused on unit bias

Partnership announcement(s): Major L2s and DeFi protocols will begin using white-labeled pxETH, this increases native TVL for them and also for Dinero with all fees flowing to Dinero, no incentives required

Monarch launch: Institutional partnerships cement Dinero as a leader in the cross-over space of TradFi and DeFi

New Products (Longer Term)

Dinero Relay to be announced Q4, launched Q1 2025. Additional utility to pxETH and the ability to own and transact in block space

Pirex

Potential partnerships with other major CVX holders, given the relative size of Pirex it runs largely on its own

Hidden Hand

No major initiatives though a number of large traditional finance companies are now taking Paypal’s lead in exploring on-chain interaction

Appendix

Why Dinero LSTs Scale Yield

Two Token Model

Dinero LSTs (“DLSTs”) are not staked 1:1 to the Ethereum beacon chain. A portion earn direct ETH staking yield (senior tranche) and the remaining portion earn DeFi yield (junior tranche). This breakdown actively fluctuates. The structure provides higher ETH staking yield as long as less than 100% of DLSTs are staked but stakers receive allocation for the full amount. Given Dinero’s institutional product will be staked, DeFi LST users have opportunities to earn outsized yield by using DLSTs.

DeFi Operations

By running all validators themselves, Dinero can pass on MEV and incentive fees to stakers, further increasing yield. Through its operations, Dinero also controls a large portion of Convex voting power which it can use to direct DeFi incentives to its native LST thereby increasing yield to the junior tranche of the structure. The future relayer product will add further yield through its ability to auction off block space.

White-Label Solutions

Dinero provides the infrastructure for other protocols to launch LSTs, it does not however provide the incentives – these come from the protocols themselves. Incentivized LSTs, at zero marginal cost of Dinero, provide another avenue to harvest yield in DeFi for the junior tranche of DLSTs. All of the junior tranche incentives assure the senior, ETH yield tranche, has the highest yield of any LST.

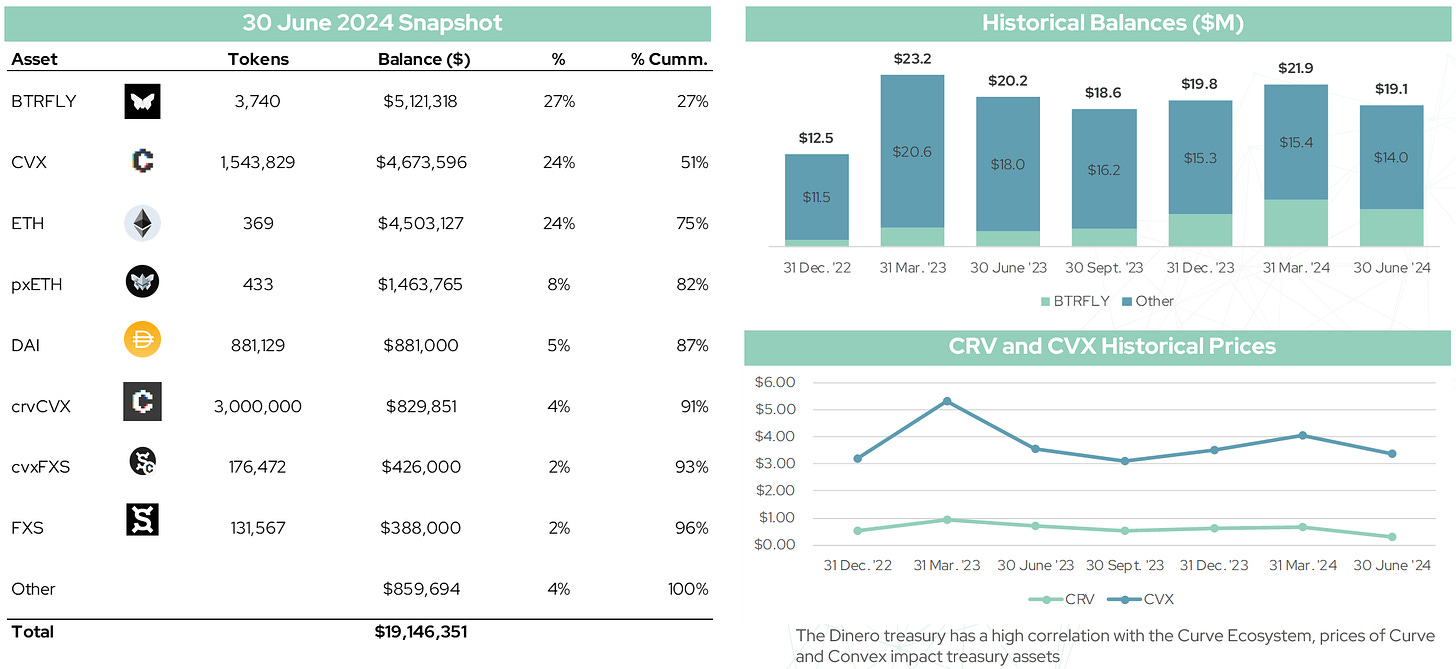

Historical Revenue and Yield

Dinero products produce consistent fee revenue that is distributed to stakers. Given the high yielding nature if its products, Dinero TVL is more valuable than that of other LSTs. Pirex and Hidden Hand are both low-maintenance assets with long operating histories that produce stable cash flows. Although excluded from the revenue calculation, the treasury assets also produce substantial income to offset DAO costs. With a treasury balance of over $19M, approximately 75% in non-native assets, the runway for Dinero is substantial and the protocol is at no risk of insolvency.

DAO Expenses

DAO expenses are exclusively funded from the treasury and do not impact yields to stakers from other Dinero products.

BTRFLY Token, Unlocks, and Allocations

Relative Price Performance

Treasury and Historical Balances

Trade Analysis and Volume

About Florin Digital

General Disclaimer

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any fund, including the digital asset strategies described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. There is the possibility of loss, and all investment involves risk including the loss of principal. Florin Digital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Florin Digital and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions.

It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity, security, or asset. Florin Digital has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.