Euler Finance - Long Tail Innovation, Fire Sale Price

The relaunch of Euler v2 and the ultimate DeFi comeback story

If presentation format is preferred, the full deck can be viewed here

Executive Summary

Euler showed incredible promise of an innovator in a dormant space in the crypto markets that was ripe for disruption

A $200M exploit - even with minimal actual losses - caused the value of the EUL token to plummet

In-depth due diligence quickly revealed EUL was an asset trading at a generational low price with a viable revival story at play

By slowly accumulating EUL tokens daily in a low volume environment, building a position at an extreme discount was still possible

The relaunch of Euler Finance continues to serve as a top case study for why we believe active management in liquid markets is extremely important in the digital asset industry

Overview of Euler Finance

Euler Finance (“Euler”) is a modular lending platform built on Ethereum that enables users to permissionlessly lend and borrow assets. The protocol is also in the process of building multi-chain deployments for the core borrow-lend functionality as well as new products like a DEX, an overcollateralized stablecoin, and innovative oracle products.

The team behind Euler is Euler Labs (“Labs”), a UK-based operating company. Michael Bentley is the CEO of Euler Labs and the company has approximately 25 employees

In June 2021, Labs raised $32M from Tier 1 investors including Haun Ventures, Paradigm, Variant, and Coinbase in a “DAO Treasury diversification round” (per the company) at approximately $375M valuation (Details of the round were not disclosed though it implies a price of $13.80 per token)

In March 2023, the protocol was exploited for nearly $200M. The funds were eventually returned and the hacker was prosecuted in the EU. After the hack, the protocol was completely paused before a restart

In January 2024, the team and core contributors began a series of releases that culminated in a new whitepaper for Euler 2.0 and a subsequent relaunch of the protocol

Market Landscape: Dormant DeFi 1.0

Permissionless, overcollateralized lending markets were the first DeFi innovation. Akin to repo desks at global investment banks, decentralized finance reinvented what it is to borrow short-term.

Compound Finance (“Compound”) revolutionized much of what permissionless lending is today by allowing users to access the platform and borrow in seconds. Aave (formerly ETH Lend) competed closely with Compound and the two largely dominated the space. Between Compound and Aave, few new entrants have been able to take and retain any sort of meaningful market share.

The founders and founding teams of both protocols have largely moved on to new endeavors, however. This left a demonstrable gap in the space, giving room to new challengers to emerge who were willing and able to innovate further.

In 2022, Euler emerged as a likely candidate to disrupt the sleepy space with a series of ideas that expanded outside of the traditional DeFi borrow-lend space. In the bull market of 2021, Compound and Aave commanded a combined valuation of about $5B despite DeFi infancy. We benchmark the DeFi borrow-lend market to be approximately the same size today with embedded growth as lending returns to the space.

Today, we believe there is an approximately $2B of market value to be filled by more advanced and sophisticated lending products.

The Hack and Aftermath

The Hack

On March 13, 2023 Euler was exploited for nearly $200M. Despite having six security audits, Euler was still the victim of a hack. The protocol was exploited via a flash loan attack. Assets were borrowed without collateral and returned in the same transaction (for non-crypto natives, note that multiple transactions can occur in a single block).

Consistent with this type of exploit, a flash loan attack was used to trick the protocol into believing it had assets that it actually did not have. In the next step, assets were then withdrawn and the collateral that remained was worthless.

There are a number of outside reports that focused on the details of what happened, but we will not focus further here.

By the following week however, the funds (nearly $200M) were returned by the hacker

The Aftermath

In what we believe to be the correct course of action, the team did what they could to pause the protocol and stop any further attacks. More security firms were engaged, law enforcement was involved, negotiations took place, and large bounties were enacted to incentivize help.

Operationally, the protocol cut DAO expenses via a proposal in May 2023 doing what it could to reduce burn immediately. The company, Euler Labs, also went through a series of layoffs to reduce costs. Though discussions were not explicitly public, historical reads through the Euler Discord server show consistent discussion around restarting the protocol and picking up where the team had left off.

The Revival

Survival

Despite no outward facing protocol, Euler Labs continued to be active and never deviated from the commitment to relaunch Euler v2 despite numerous setbacks. From Discord discussions, to forum posts and proposals, and events and social media activity, all signs pointed to protocol relaunch. Meanwhile, the price of the token remained at post-hack levels.

Euler 2.0

Ethereum Vault Connectors (“EVC”) were launched publicly January 12 after being confirmed a few months prior. To provide more context, EVCs add liquidity, enhance interoperability, add new flexibility for asset properties (note RWAs), and create a standardized and cohesive approach for building lend/borrow functionality.

The Euler v2 Litepaper was released February 22, 2024. The new paper highlighted differentiated vault classes, nested vaults, an introduction of synthetic assets, new liquidation mechanisms (via reverse Dutch Auctions), as well as the introduction of EVCs.

For PR, Michael Bentley, Labs’ CEO, and Laurence Day, and advisor to the protocol and a known DeFi builder, discussed Euler v2 and their vision at ETH Denver on March 1.

A Great Setup, a High Quality Product

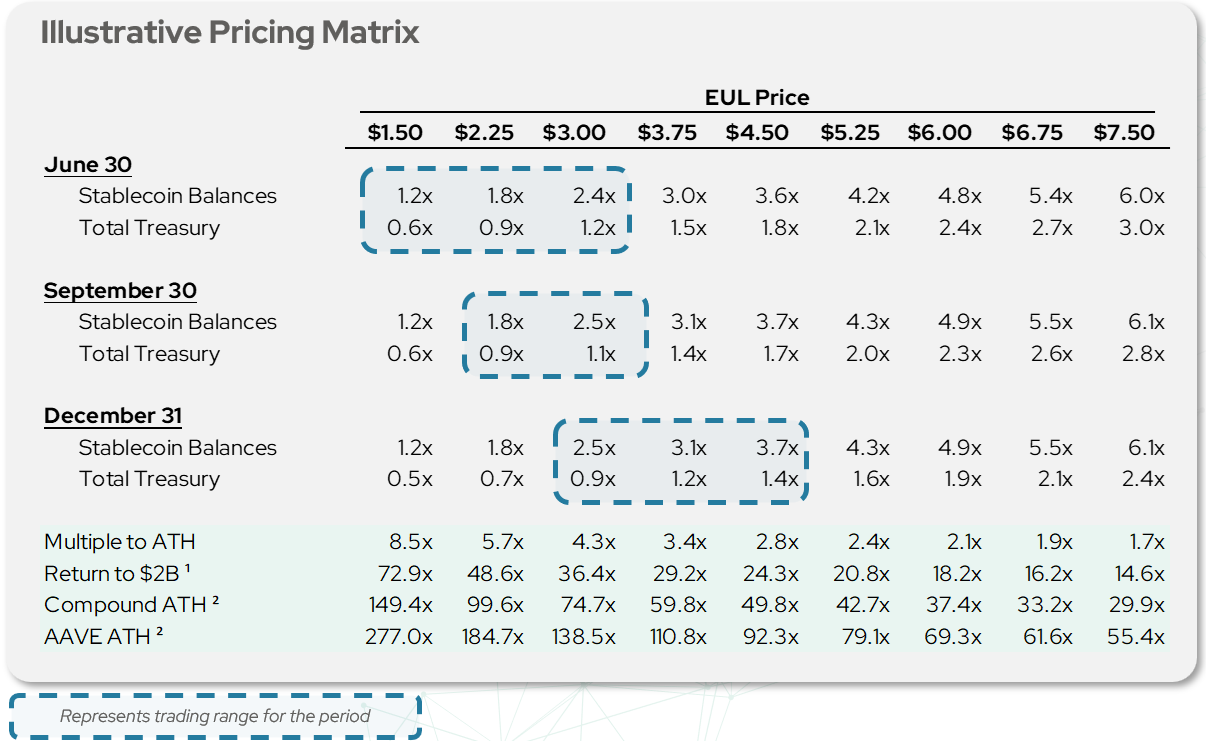

With a low burn rate and healthy treasury, EUL represented an extremely asymmetric upside opportunity. For nearly six months, EUL could be purchased for an extremely low multiple of its treasury value (0.6x to 1.4x). At its lows, the protocol could even be purchased in the open market for less than 2.0x cash balances (measured in USDC stablecoins).

These are metrics indicative of a distressed asset not of one with substantial runway and an ultra-high-growth product. Underwritten to peer valuation levels, Euler holders significant return potential of well over 50x.

Building a Position and Maintaining Outlook

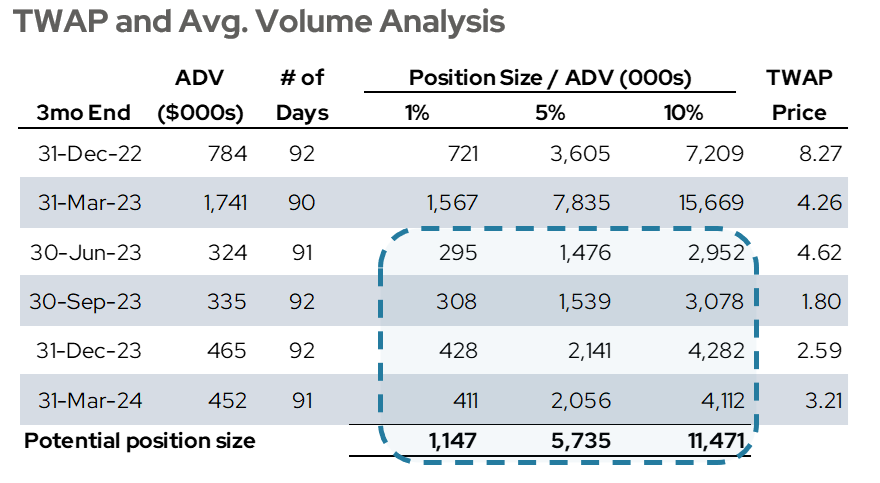

Despite the massive decrease in liqudity, ample capacity was available to buy EUL in the open market.

After the hack, volume dropped significantly from approx. $1.0M per day to well below $400k average daily volume across all venues. However, buildings a sizable position was still possible yet required patience and confidence that volume would eventually increase as the asset regained favor.

An analysis of top holders also shows little movement after the incident.

Excluding insiders, top wallets held over 25% of the outstanding supply of EUL. Monitoring these top wallets showed no material changes after the hack, the largest holders of EUL remained steadfast.

About Florin Digital

Florin Digital is a crypto-asset investment firm deploying at the intersection of finance and technology.

We seek out early-stage opportunities in liquid markets which present an asymmetric risk-reward profile. Our thesis-driven, hands-on approach allows us to unlock significant latent value in the teams and protocols that we partner with.

General Disclaimer

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any fund, including the digital asset strategies described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. There is the possibility of loss, and all investment involves risk including the loss of principal. Florin Digital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Florin Digital and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions.

It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity, security, or asset. Florin Digital has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.