Ethena: providing turnkey access to popular investment strategies

A popular strategy in traditional finance (TradFi) is the so-called basis trade, a strategy in which a trader buys an asset while simultaneously selling its futures contract, thereby balancing the opposing directional exposure of each leg and earning a profit from the difference between the futures price and the spot price as they converge. Given futures markets are historically biased to the long side over the long run, it is for the most part a positive-yielding trade.

The basis trade market in US Treasury futures alone is estimated at over $500 billion. While also widely utilized in commodities markets, the strategy was introduced to crypto markets when Bitcoin futures launched on the CME in 2017, essentially delivering risk-free yields ranging from 7-15%+ annually.

Arthur Hayes, a well-known crypto entrepreneur and investor took the basis trade a level further by conceptualizing the NakaDollar, a structured product designed to maintain peg to the US Dollar by investing in Bitcoin (BTC) and simultaneously shorting its perpetual futures contract. The vision was ambitious: create a fully crypto-native stablecoin supported by the deep liquidity of crypto markets and capable of scaling supply to hundreds of billions of dollars.

Only a few months later, Ethena Network took this theory to practice. Instead of Bitcoin, Ethena started off with Ethereum and built the operational infrastructure to deploy the strategy at scale. While Ethena relies on the liquidity of centralized exchanges, it has tokenized (the crypto equivalent of securitizing an investment product) the strategy by issuing a new product, USDe, a digital representation of the structured product on the Ethereum blockchain.

The result has been nothing short of impressive. Just one month after launch, USDe’s supply exceeded $1 billion, making it one of the fastest-growing dollar-based crypto assets. In TradFi benchmarks, this would have placed Ethena among the top 2,000 banks in the US, a milestone which normally takes decades. Just like the NakaDollar for BTC, Ethena’s stablecoin combines a spot ETH position with an equivalent notional short ETH position via perpetual futures to produce a stablecoin (USDe) which is pegged to the US dollar. The stability comes from the offsetting long and short, while yield is earned from i) the funding rate on the short futures position and ii) the rewards from staking ETH. The result is a stable USD-pegged asset that wraps a hedge fund-like strategy into a simple token, offering global access to liquid and composable institutional-grade yield.

Simply said, tokenization is a cost-effective way of democratizing access to profitable and sometimes complex trading strategies which are normally exclusive to the most sophisticated investors. We see this technological breakthrough setting a trend by turning a myriad of TradFi investment strategies into tokenized turnkey solutions available at a low cost and on a global scale. Instead of tokenizing cash (as with highly successful stablecoins like USDT or USDC), firms can now tokenize yield-bearing assets and money market instruments with instant global distribution. BlackRock’s BUIDL and Franklin Templeton’s BENJI tokens are successful examples of on-chain money market funds which provide investors with 4%-5% yields in a composable and highly liquid environment.

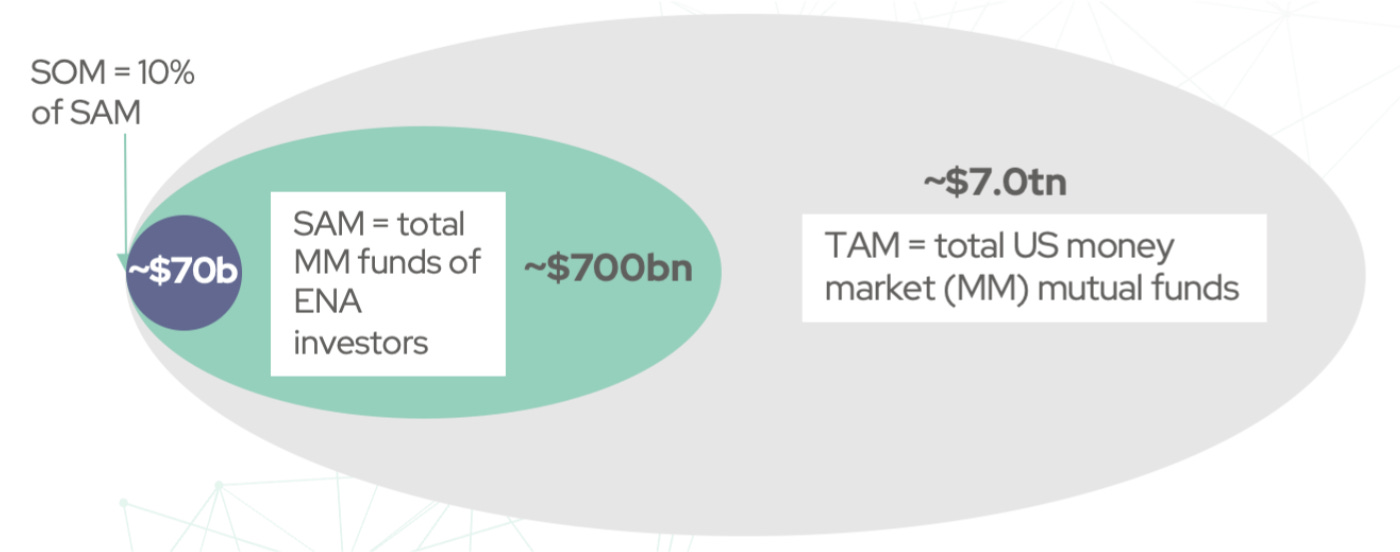

The long-term potential of tokenizing TradFi strategies is significant. The total addressable market for such products is essentially the total market for short-term dollar investments - the US money market mutual fund industry alone is about $7 trillion in assets. Even if only 5% of that market were to be tokenized in the coming years, we would see a $350 billion influx of yield-bearing dollar tokens on public blockchains. This would dramatically change the current stablecoin landscape and mark a tipping point for TradFi products migrating to crypto rails.

Much like the arrival of mutual funds and ETFs made complex portfolios accessible to a wider audience, the tokenization of TradFi strategies will widen access to yields and opportunities that were once gated behind banks and brokers. The convergence of crypto infrastructure and traditional investment products means that a blockchain wallet address can now hold the equivalent of a money market fund share or a hedge fund strategy, all with the utility and convenience of digital assets: Want to tap US treasury yields without a brokerage account? Buy a token. Need liquidity on a weekend or a holiday? These tokens are traded globally 24/7.

The finance industry is going digital through tokenization and we believe this represents a fundamental market shift. Much like the early days of the internet, where huge markets were transformed and new ones created, trillions of dollars in traditional assets are going to migrate onto crypto-native platforms. It is happening as we speak and applications like Ethena are leading the way.

About Florin Digital

www.florindigital.io

General Disclaimer

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any fund, including the digital asset strategies described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. There is the possibility of loss, and all investment involves risk including the loss of principal. Florin Digital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Florin Digital and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions.

It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity, security, or asset. Florin Digital has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.