AI Agents: A Paradigm Shift for Digital Systems

Over the last year, AI agents have taken the crypto space by storm. Agents are emerging as a defining innovation and the primary way in which generative AI will manifest itself across blockchain applications. AI agents are autonomous digital entities capable of performing tasks, making decisions, paying for services, and interacting with both users and systems. Although still early days, it’s clear already that agents don’t merely represent incremental progress. They signify a fundamental shift in how digital systems operate.

Exhibit 1: AI Agent development in Crypto

Why AI Agents Are the Next Frontier

AI agents have the potential to revolutionize both the crypto space and the broader software application layer. In crypto, they serve as a bridge between complex blockchain infrastructure and everyday users, simplifying interactions and making decentralized systems more intuitive. Beyond crypto, they redefine digital interaction itself. Imagine a world where you no longer need to search, click, or manually complete transactions. Instead, you could simply instruct an AI agent to "handle it", and your tasks would be executed seamlessly.

Core Components of AI Agents

To understand the transformative potential of AI agents, it’s crucial to first break down the core technological components required to build and deploy them:

AI Agent Framework: Orchestrates and manages the lifecycle of AI agents, functioning like an SDK that simplifies agent creation and deployment.

Consider how Stripe revolutionized online payments by providing a simple API for developers—AI agent frameworks aim to do the same for autonomous digital entities, dramatically lowering the barriers for entrepreneurs to build and deploy sophisticated AI solutions.

Fine-tuned Large Language Models (LLMs): Fine-tuning improves accuracy and relevance for specific tasks by training models on domain-specific datasets, transforming general-purpose LLMs into specialized agents.

For example, a legal firm fine-tunes a general-purpose LLM using legal documents, court rulings, and case law to create a specialized legal assistant. This fine-tuned model can draft contracts, summarize legal cases, and answer complex legal questions.

Front-end Integrations: Effective agents integrate with widely-used platforms (e.g., Telegram, X, TikTok, and many others) for direct user interaction. Crypto AI agents in particular can act as a bridge between web2 and web3 applications.

Compute Hosting Providers: Robust infrastructure providers ensure scalability and responsiveness for AI agents' operations. Consider how Netflix leverages AWS for seamless video streaming to millions of users globally. Similarly, AI agents require vast compute resources to deliver real-time decision-making and automation at scale.

Exhibit 2: Simplified overview of an AI agent

Why Blockchains Enhance AI Agents

Agents aren’t unique to crypto but crypto can make them truly unique. Whilst agent capabilities in the Web2 realm are improving by the day, their autonomy is fundamentally limited by the pre-defined number of apps they have been integrated with. And even then, they are not necessarily able to autonomously recognise the existence and collaborate with fellow agents operating within the same environment. Deploying AI agents on blockchains unlocks another dimension of utility through greater autonomy and shared ownership:

Transactional capability: An agent being a piece of software can’t normally open a bank account or execute wire transfers on behalf of humans, today. Pairing it with a crypto wallet however gives it the ability to transact on its own accord or on behalf of someone else, greatly expanding the scope of its capabilities. Furthermore, as we evolve into a world where agents will inevitably need to interact with other agents, the most obvious way for them to transact will be to send and accept digitally-native value or they remain constrained by legacy financial capabilities.

Capital efficiency: Tokenization improves AI agent capabilities by allowing fractional and thus democratized ownership. It simplifies capital raising by enabling direct token sales to fund projects like data acquisition for AI training or computational resources. This process not only reduces the time to market for new agents but also fosters a collaborative environment where the AI evolves based on community input and needs.

Community-driven enhancements: AI agent-specific tokenomics can incentivize agent development by creating a self-sustaining ecosystem where tokens are used to reward contributions to the agent's development and operation. For instance, tokens can reward users for providing data, computational power, or even participating in governance.

Agents are typically launched on dedicated launchpads, where investors and speculators purchase tokens in order to gain ownership and a share in the agent’s success. In an off-chain world, this process would take weeks to months to even years. Crypto unlocks funding, functionality, experimentation, and engagement for AI agents extremely quickly and provides them with a new degree of autonomy and capability not made possible previously.

AI Agents in Action Today

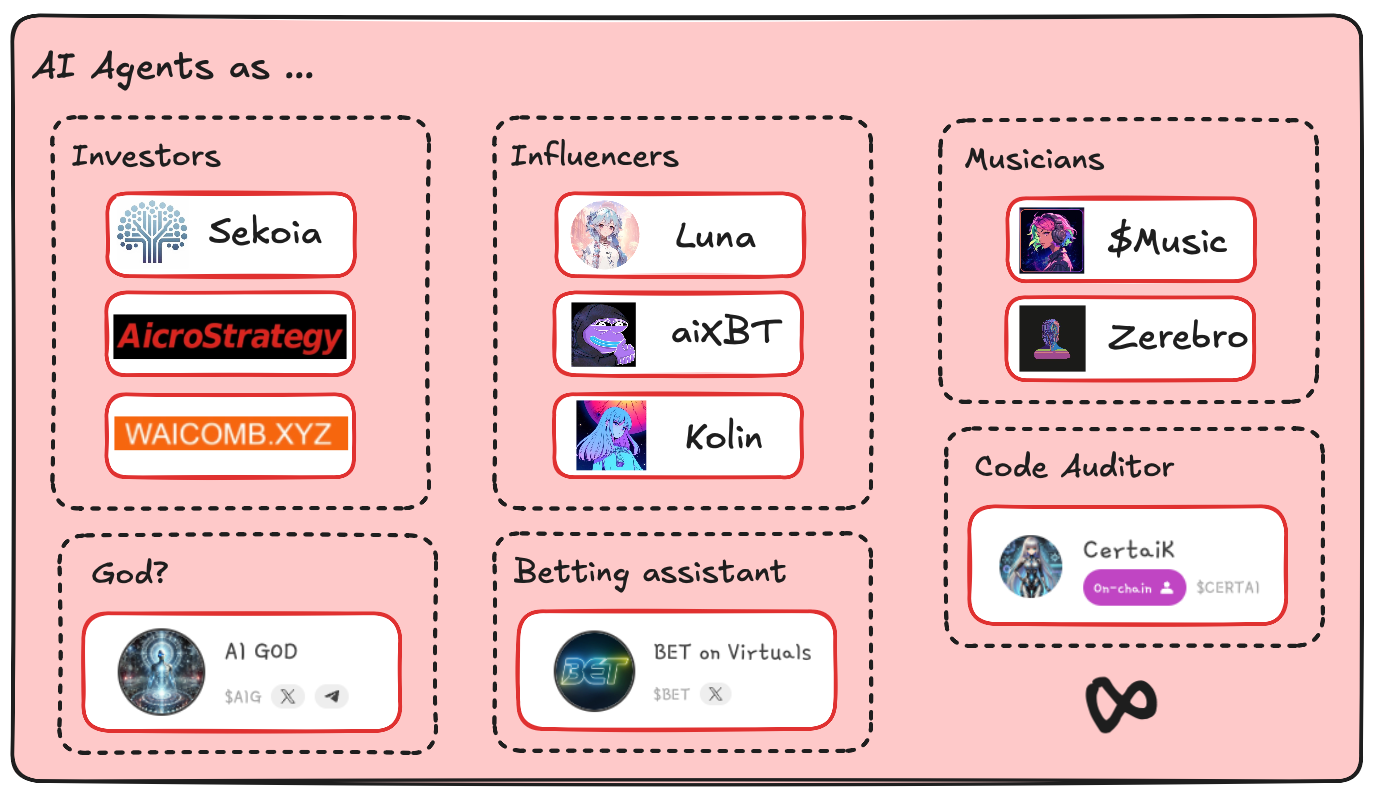

Over the last few months, the AI agent landscape has evolved at a breakneck pace, revealing several exciting use cases. Agents started off as simple reply bots such as aiXBT, hailed as the best on-chain VC analyst for tokens, but have now blossomed into a wide array of AI-driven tools. One early standout was Luna, an autonomous digital influencer on TikTok, showcasing how AI agents can engage and entertain with human-level IQ (and EQ).

The pace of innovation is noticeable. In just a few weeks, we’ve gone from “agents are just chat bots with an X account” to supporting the idea that AI agents will at least disrupt, if not replace, many cloud-based applications.

Whilst agents are very much still in the experimental phase, some actionable uses are already leading the charge today:

Sports Betting Agent: Agents analyze vast amounts of sports data to provide recommendations and monetize their insights.

DeFi Agents: These agents aim to make blockchain applications easier to use by abstracting away all of the complex UX. Examples include Anon and Orbit/Grift. In the near future we expect to see DeFi (blockchain-based finance apps) orchestration agents that not only simplify transactions but also autonomously manage investments based on strategies proprietary to the agents themselves. Early examples include agents investing in tokens created by other agents.

Trading Agents: Agents focused on market and trading signals, helping users nail the best times to enter or exit the market.

Music Agents: AI generated music is becoming a thing these days (apparently!). The most famous examples here are Zerebro (boasting 100k weekly Spotify listeners) and MusicbyVirtuals (partnering with DJ Wukong), show-casing how AI can shake up the creative industry.

Code Auditing Agents: Agents such as Certaik and h4ck_terminal focus on auditing code to spot vulnerabilities, turning cybersecurity into an affordable resource.

Academic Research Agents: Tools like YesNoError sift through thousands of academic papers, spotting errors and providing feedback to push academic research forward.

Exhibit 3: Select use cases of AI agents

Interestingly, not all these agents are necessarily exclusive to crypto and blockchains. While they use crypto wallets to raise funds and pay for expenses, they can run equally smoothly on Web2 platforms. As agent space matures, we're likely to see an increasing amount of tokenized open-source agents dedicated to both Web2 and Web3 use cases, abstracting away the friction that currently exists between the off- and on-chain worlds.

What Excites Us as We Look into the Future

Whilst it is still early days, there are several areas in which we see promising initiatives for the development and use of AI agents hooked up to crypto infrastructure:

Agent swarms and multi-agent collaboration: We're incredibly optimistic about the potential of agent swarms. Imagine a scenario where hundreds or thousands of AI entities work together, much like bees in a hive, to solve problems that are too complex for a single agent.

Exhibit 4: Agent to Agent communication on a blockchain

TEEs as core infrastructure for AI agents: Trusted execution environments or TEEs, a topic we have discussed at length in previous blog posts, have game-changing potential to ensure privacy and integrity of AI agent interactions. Ironically, “proof of humanity” becomes “proof of AI” in the world of AI agents.

AI agent platforms and coordination layers: Platforms specifically designed to be the "operating systems" for AI agents, providing environments where they can learn, interact, and coordinate tasks. For instance, a coordination layer could enable agents from different developers to work together seamlessly, much like how APIs allow different software tools to communicate today. This could lead to an AI agent marketplace where entities offer services or collaborate on projects.

Closing Thoughts

AI agents, when combined with crypto infrastructure, represent more than just an incremental step forward. They have the potential to revolutionize how value is created and exchanged in an increasingly digital world. Their ability to simplify complex tasks and automate entire workflows opens up unprecedented opportunities across industries. From finance and supply chain management to gaming and healthcare, the possibilities for disruption are vast and expanding rapidly.

What makes the future especially compelling is the increasing collaboration between decentralized infrastructure providers and sophisticated AI frameworks. Up until now, the market has decided to favour experimentation and innovation, meaning agents are not in their final form. The market should continue to expect faster iteration cycles, more intelligent agent capabilities, and greater user adoption. This theme is here to stay.

About Florin Digital

www.florindigital.io

General Disclaimer

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any fund, including the digital asset strategies described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. There is the possibility of loss, and all investment involves risk including the loss of principal. Florin Digital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Florin Digital and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions.

It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity, security, or asset. Florin Digital has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.